Making the Most of Online Payments

For businesses, including sporting organisations of all sizes, it’s important to fully maximise your organisation’s online payment capabilities. Efficient online payment systems go beyond just processing transactions – they can streamline financial operations, enhance customer experiences, and unlock new revenue opportunities. With the Australian Banking Association reporting that 98.9% of payments by consumers now being made online or by apps¹, it is more important than ever to know how to optimise your payment facilities.

This article explores strategies to optimise online payments, leveraging platforms like Stripe and GameDay to improve efficiency, security, and business insights.

Optimising Your Online Payment System

Streamlining Payment Workflows

A well-integrated online payment system should reduce administrative burdens and eliminate inefficiencies. Automating recurring payments for subscriptions and memberships can help maintain a steady cash flow while reducing manual effort. Real-time payment tracking and automated reconciliation improve financial transparency, making it easier to monitor transactions and reduce errors. By integrating payments with accounting software like Xero, organisations can further minimise manual data entry and ensure accurate financial reporting.

Leveraging Data for Business Insights

Online payment platforms provide valuable transaction data that can be used to understand your customer or member behaviour. Analysing payment trends helps identify peak transaction times, allowing organisations to adjust marketing efforts and resource allocation accordingly. Tracking failed payments and setting up automated retries can help recover revenue that might otherwise be lost. Additionally, AI-driven fraud detection tools can flag suspicious transactions, improving security and minimising financial risks.

Enhancing Customer Experience with Flexible Payment Options

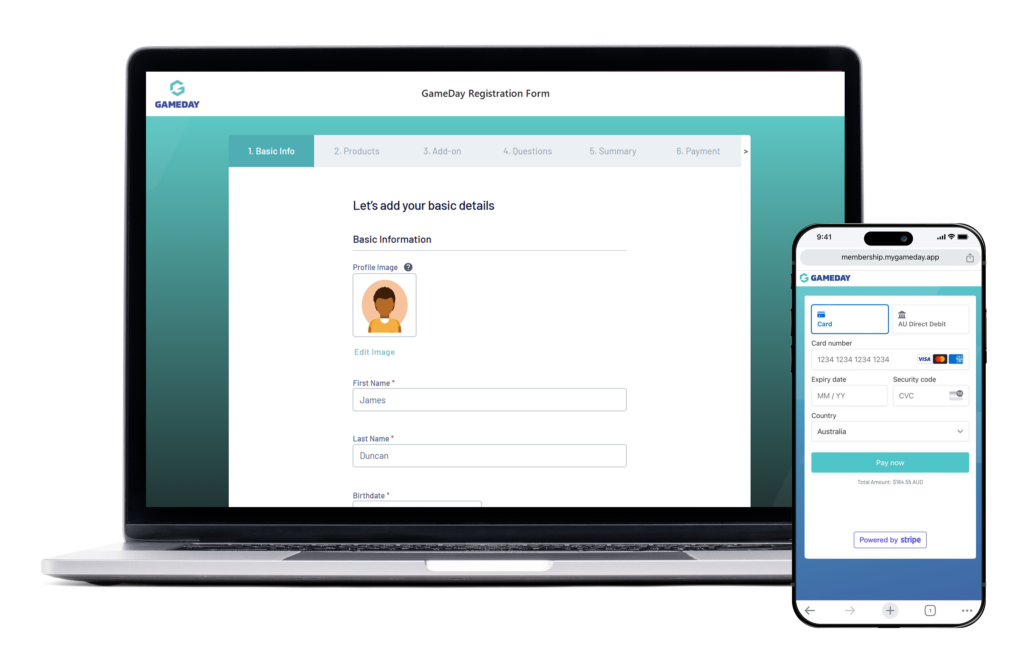

Customers and members expect a seamless payment experience, so offering multiple payment options is crucial. Credit cards, Apple Pay, Google Pay, and direct debit provide users with flexibility and convenience. Enabling one-click checkout and stored payment details makes repeat transactions smoother, improving customer satisfaction. Ensuring mobile-friendly payment solutions also caters to users who prefer to complete transactions on their smartphones, increasing conversion rates and engagement.

Maximising Revenue Through Payment Innovation

Implementing Split Payments and Multi-Tiered Settlements

For organisations managing multiple revenue streams, such as sports clubs handling sponsorships, event registrations, and membership fees, using split payments ensures funds are allocated correctly. GameDay’s online payment system can help facilitate this by automatically distributing payments across different operational levels, reducing the need for manual reconciliation and improving financial efficiency when involving multiple stakeholders.

Reducing Payment Friction with Subscription Models

Subscription-based payments provide a reliable revenue stream while enhancing member retention. Automating billing eliminates the need for manual renewals, reducing churn and improving overall financial stability. For organisations reliant on memberships, this approach ensures continuity and minimises the risk of revenue loss due to lapsed payments.

Expanding Market Reach with Global Payment Support

If an organisation has international customers, enabling multi-currency transactions through platforms like Stripe ensures accessibility for a broader audience. Stripe’s support for multiple payment methods and currencies reduces barriers for global customers, making it easier to expand market reach and grow revenue streams.

Security and Compliance: Ensuring Trust in Transactions

Enhancing Security with Fraud Protection Tools

To protect against payment fraud, organisations can implement two-factor authentication and encryption to secure transactions. Fraud detection tools, such as Stripe Radar, help identify and block suspicious payments before they impact revenue. Maintaining PCI DSS compliance ensures that customer payment data is handled safely, further strengthening trust between businesses and their customers.

Improving Payment Reliability with Smart Routing

Smart payment routing ensures transactions are processed through the most efficient and cost-effective channels. Platforms like Stripe automatically reroute failed transactions to alternative payment processors, reducing decline rates and improving overall payment success rates.

Ensuring Regulatory Compliance

Staying updated with regional payment regulations is critical to avoiding financial risks. In New Zealand, for instance, payment delays cost businesses over $800 million annually, according to a Xero report². Ensuring compliance with industry standards and government policies not only helps mitigate risks but also improves financial operations and cash flow management.

Making the most of online payments is about more than just accepting digital transactions—it’s about optimising processes, improving customer satisfaction, and leveraging data for growth. Platforms like Stripe and GameDay provide the tools to take an organisation’s payment capabilities to the next level.

Whether it’s a large enterprise, a small business, or a sporting organisation, refining an online payment strategy can significantly enhance financial management and drive long-term success.

Click here to view more of GameDay’s Focus Features.

¹Australian Banking Association: 2023 Customer Trends Report, 2023 – https://www.ausbanking.org.au/wp-content/uploads/2023/06/Bank-On-It-%E2%80%93-Customer-Trends-2023-1.pdf

²Xero: Late payments cost Kiwi small business more than $800 million, 2024 – https://www.xero.com/nz/media-releases/late-payments-cost-kiwi-small-business-over-800-million/